Improve detection accuracy by providing feedback on risk recommendations you received from Mosaic. labeling helps enhance our machine learning (ML) models and improve our fraud detection algorithms. Labels categorize entities based on their fraud status, allowing the ML model to adapt and learn from both confirmed and suspected fraud cases, as well as legitimate activities. This dynamic feedback loop ensures Mosaic stays up-to-date with evolving fraud patterns.

Unlike rules that completely override risk recommendations, labels are meant to adapt risk detection strategies in real-time.

Labels categorize entities based on their fraud status. When you apply labels, they have both immediate and long-term impact:

- Immediate impact: Labels directly influence the next recommendations by adjusting the reputation of labeled entities.

- Long-term impact: Over time, Mosaic's ML models learn from accumulated labeling history. As a result, recommendations involving previously labeled entities explicitly reflect past analyst decisions through dedicated reason codes. For more details, see Understand label impact.

The label type helps distinguish recommendations. To improve detection accuracy, you can assign one of the following labels:

- Confirmed fraud: For entities confirmed to be involved in fraudulent activities.

- Suspected fraud: For entities suspected of fraudulent behavior that has not yet been confirmed.

- Confirmed legit: For entities confirmed to be legitimate and not involved in fraud.

- Undetermined: For entities for which the fraud status is undetermined.

Labels are assigned to subjects—attributes, indicators, or entities that make an action fraudulent or legit. Below are available label subjects:

- Action ID: Unique identifier for a specific action or transaction within your system.

- Correlation ID: Unique identifier that links related actions or transactions, helping to track sequences of events. Correlation IDs remain the same throughout user interactions.

- Security insights: Fraud ring ID / Fraud campaign ID; represents an interaction pattern rather than specific actions.

- User ID: Unique identifier for individual users in your system. When labeling a User ID subject, you are classifying the user account as fraudulent or legitimate. This can be particularly useful for "New Account Fraud" or "First-Party Fraud" use cases. For other scenarios, such as compromised accounts, it's better to use a subject that relates directly to the fraud events rather than the user accounts involved.

- IP address: (via API only) The IP address from which the action was performed. Consider labeling an action ID instead in order to take into account other network-related parameters, such as ASN, domain, the IP address's history, and other enrichment data.

With the multifaceted fraud landscape, it is best to provide labels without being too discrete, especially when reviewing risks manually. Tagging a fraudulent action or pattern rather than a specific entity (such as an IP address) helps build a more thorough risk profile and account for multiple signals and parameters. However, when leveraging external security tools, you usually have indicators of fraudulent interactions (e.g., from chargebacks), problematic user accounts, or suspicious IP addresses. See Mosaic's recommendations on setting label subjects depending on your risk assessment workflow:

- Manual risk review: Security Insights, Action ID, User ID

- Leveraging external data: Correlation ID, User ID, IP Address

Labels are used in various fraud scenarios, including the use cases listed below. While optional, you can specify the fraud scenario used, if known.

- Account Takeover: Identifying and preventing unauthorized access to user accounts.

- First Party Fraud: Detecting fraudulent activities initiated by the account owner.

- Identity Theft: Protecting against cases where a fraudster uses someone else's identity.

- Money Mule: Identifying users involved in transferring stolen funds.

- Bot Attack: Detecting and preventing automated fraudulent activities.

- Synthetic Identity: Identifying fake identities created by combining real and fake information.

- Social Engineering: Recognizing and preventing fraud resulting from manipulative tactics used to deceive individuals into divulging confidential information.

Labels can be derived from multiple sources, including but not limited to:

- Manual review: Analyst-driven investigations that identify fraud or confirm legitimacy.

- Customer complaints: Feedback from customers reporting unauthorized activities or fraud.

- Chargebacks: Financial disputes indicating fraudulent transactions.

- Other vendors: Labels provided by third-party fraud detection tools or external data providers integrated into your system.

Collaborate with analytics tools or internal systems to extract relevant Correlation IDs or User IDs. This will ensure accurate labeling and improve the effectiveness of Fraud Prevention. Integrating these tools can streamline the process and ensure consistent data quality across your operations.

From the Recommendations page, click the Set label button; for individual actions or in bulk.

The GIF below shows the old label names. The current UI displays the updated label names listed below:

- Known malicious → Confirmed fraud

- Suspected malicious → Suspected fraud

- Known legit → Confirmed legit

- Unknown → Undetermined

Import labels in bulk from the Recommendations page by uploading a CSV file with the following structure:

- Columns must be named as follows:

label_type,subject_type,subject_value,source,use_case - The first 3 columns are mandatory, while the last two (

sourceanduse_case) are optional - Within columns, the values must comply with API reference (enum values)

Some file examples:

subject_type,label_type,subject_value

ACTION_ID,CONFIRMED_FRAUD,a05f8ae1-718f-4c33-a20c-682df281af7cAssign labels via Send label API.

Set labels using Automated workflows.

On the Recommendations page, you can see recommendations with assigned labels by adding the Label type column or by filtering labeled or unlabeled recommendations. You can notice the label next to a subject (user ID, action ID, etc.) when reviewing recommendation details.

The Recommendations table displays a wide range of information related to each recommendation, including label details, telemetry data, and other contextual information that helps you understand the risk assessment.

The GIF below shows the old label names. The current UI displays the updated label names listed below:

- Known malicious → Confirmed fraud

- Suspected malicious → Suspected fraud

- Known legit → Confirmed legit

- Unknown → Undetermined

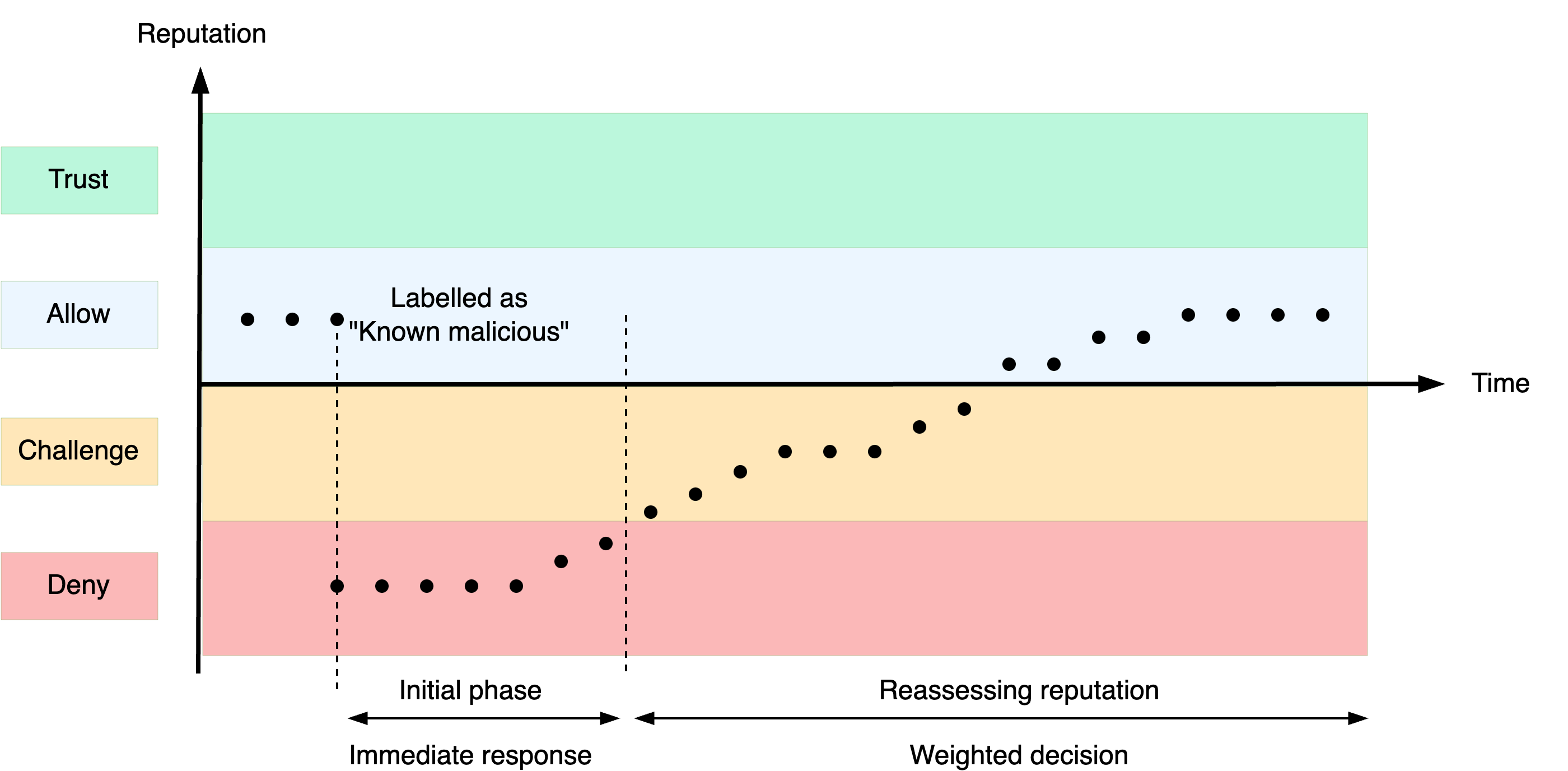

By setting a label, you update the reputation of its subject, such as a user ID or IP address. Mosaic's Fraud Prevention instantly takes this change into account for current and future recommendations.

As a first step, Mosaic temporarily adjusts recommendations using automatically created rules to improve real-time detection. For example, a fraud label may trigger a “Deny” recommendation for similar actions, while a legitimate label may result in an “Allow” recommendation. Affected recommendations include a reason reflecting the entity's updated reputation—such as DEVICE_RISKY_REPUTATION or IP_TRUSTED.

When a new action involves one of the same entities (determined automatically by the system) within a short time window, Mosaic may explicitly reflect the prior label through a label-driven reason code. For instance, if a device was involved in an action labeled as confirmed fraud the day before, the system may include a reason like DEVICE_CONFIRMED_FRAUD_ACTIVITY_LAST_DAY. These reasons provide transparency into how your analyst decisions influence real-time recommendations.

Over time, as label volume increases, Mosaic’s ML models may suggest retraining. This improves long-term fraud detection accuracy, ensuring the system adapts to evolving attack patterns while balancing security and user experience.

Submitting a high volume of labels over time contributes to more reliable risk detection. A case study shows that Mosaic's semi-supervised ML models detect fraud with higher precision when trained on labeled recommendations. In other words, the recall rate—the percentage of fraud events correctly identified—increases over time, leading to faster and more accurate prevention.

To track the work of fraud analysts, you can filter recommendations by labeling actor on the Recommendations page. The same information is also available in the Admin Portal > Admin Activity section, where you can view wider information about Admins activity in the tenant.